Buying a property checklist

Did you know, the time it takes to buy a property can take anywhere from 6 weeks to 8 months. And that's only after you've found the property that you want. Finding a suitable property in itself can take a long time.

So why does it take so long to purchase and own a collection of bricks? Some of you have already experienced this, so feel free to skip to the end where I talk about how Proptee will change things.

We want to hear about your worst and funniest stories in your property searches. Message us on twitter @PropteeApp to be featured in the next article.

1. Finding the right property: 1 to 6 months

First things first you need to find what's the right investment for you. Commercial or Residential? Are you looking for HMO or private? Do you take a bet on an upcoming location with good transport links or just stay in a big city? There are many boxes you need to tick. After all, property investing is a long-term game.

You'll spend some time browsing properties online and booking visits to ones that catch your eye. Some of them will be good but not good enough. And some will be a complete waste of time, "excuse me sir why's that ceiling leaking?".

Of course, you want to act quickly, but property is not like the stock market.

2. Making an offer: Up to 48hrs

Okay, so you've found the perfect home, with a great location and stable returns. Next, you need to make an offer, and it better be a good one.

The real estate market is hot! Most likely there are multiple people viewing this property. You now have to blindly make an offer to beat theirs, so how much should you offer?

Most people are just going to take the estate agent's advice (who btw works for the seller) and potentially overpay.

It can take up to two days for your offer to be accepted. In some cases, you can even get outbid by another buyer after this - called GAZUMPING.

3. Getting a mortgage: 2 to 4 weeks

You need to spend some time comparing mortgage rates finding a good deal from a reputable lender.

Typically sellers expect you to have a mortgage agreement in principle before making an offer on the property. This can be acquired within 24 hours. However, you better find a house quickly as they're usually only valid for 90 days.

Currently pay £1300 p/m in rent, mortgage advisor thinks I can't afford to pay more than £678 p/m on a mortgage and won't lend me more than £161k🙃

— Barty Millis - Successful Influencer (@Bertaroo) June 16, 2021

After getting your offer accepted you will need to get your mortgage approved by the lender. They will need to double-check the property and make sure that its a security that's worth risking a loan for. They will also need proof from you that you can afford to pay the loan back, i.e payslips.

4. Surveying the property: 1 to 2 weeks

It's not a legal requirement to have survey on a property, but it would be a risk not to. This is an expert inspection on the property, It's needed to identify any underlying issues before you purchase.

5. Conveyancer: 6 weeks to 3 months

So your offer is accepted, your mortgage is approved and the survey is complete. Now what?

Let the conveyancing commence! A conveyancer is a solicitor who deals in property law. They will manage the legal paperwork involved, Land registry, draft the contract and handle the exchange of money. This ensures the property is smoothly and legally transferred to you.

This doesn't come free though, conveyancers cost £850 to £1,500 (sometimes even more).

6. Completing the purchase: 2 weeks

Now all that's left is to complete your purchase. You'll exchange contracts with the seller. This can take up to 2 weeks to finalise.

You also need to pay:

- Estate agent fees (1% to 5% of the final sale price)

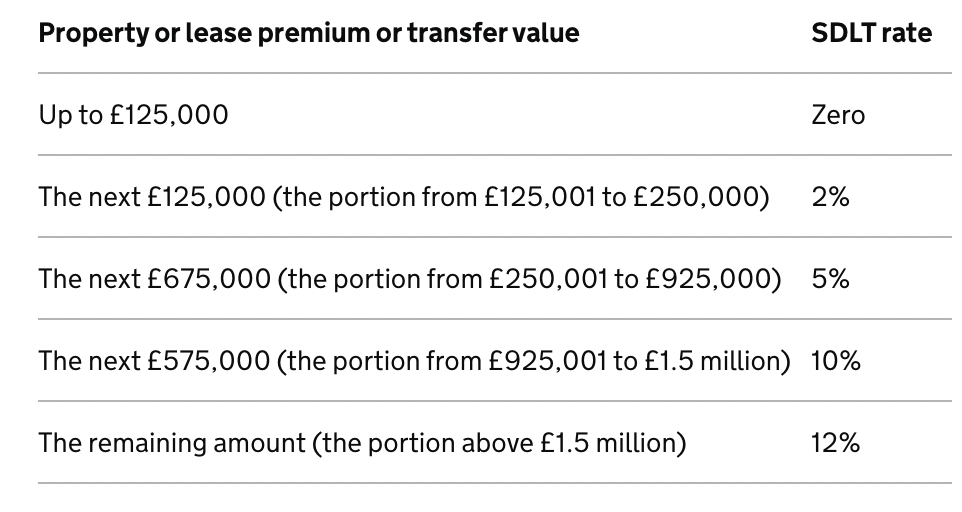

- Stamp duty - check calculator here.

Congratulations! 🎉

You're a property owner. You can sit on the sofa with a well-deserved cold beer and make passive income. You better make sure you have insurance, that boiler not going to last forever.

In total you spent:

- 10% of the real estate value on fees

- More than 6 months just buying it.

- Lost 5 years of your life expectancy due to stress. (can be more)