APR vs APY explained

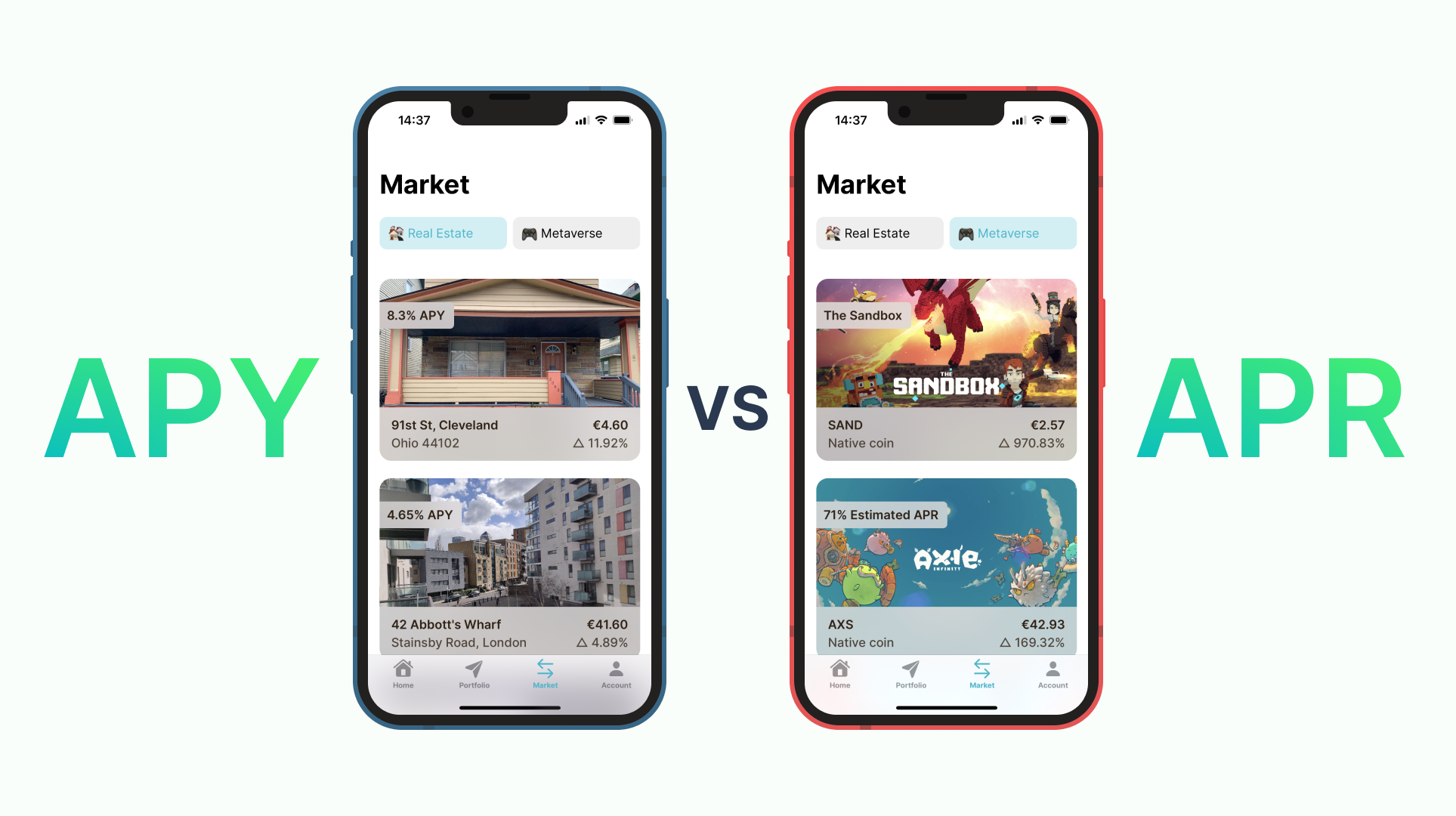

You may notice that Proptee's listings sometimes show APR and other times APY. This article aims to clear the difference between the two.

While APR and APY may sound the same, they are quite different and not created equal. APY, or annual percentage yield, takes into account compound interest, but APR, which stands for annual percentage rate, does not.

APR

APR does not take into account the compounding of interest within a specific year. It is calculated by multiplying the periodic interest rate by the number of periods in a year in which the periodic rate is applied. It does not indicate how many times the rate is applied to the balance.

APR is calculated as follows:

APR = Periodic Rate * Number of Periods in a Year

APY

Unlike APR, APY does take into account the frequency with which the interest is applied—the effects of intra-year compounding. This seemingly subtle difference can have important implications for investors and borrowers.

Here's how APY is calculated:

APY = (1 + Periodic Rate)Number of periods – 1

APR vs. APY Example

A bank might charge 1% interest on a loan each month. Therefore, the APR equals 12% (1% x 12 months = 12%). This differs from APY, which takes into account compound interest.

The APY for a 1% rate of interest compounded monthly would be 12.68% [(1 + 0.01)^12 – 1 = 12.68%] a year. If you only have the loan for one month's period, you will be charged the equivalent yearly rate of 12%. However, if you have the loan for the year, your effective interest rate becomes 12.68% as a result of compounding each month.

Conclusion

Both APR and APY are important concepts to understand for managing your personal finances. The more frequently the interest compounds, the greater the difference between APR and APY.

If you haven't used Proptee yet, then go ahead and download it from here: