What is fractional investing?

Are you interested in buying into Warren Buffett’s Berkshire Hathaway? Well, before fractional investing, you had to put down the price of at least 1 share, more than $500,000.

What’s fractional investing?

Fractional investing lets investors buy or sell less than an entire asset at a time. It was introduced to increase access to expensive stocks and it also makes it easier for investors to invest very precise amounts in a company.

Fractional investing makes the most sense for high-value assets. This way both access and liquidity can be increased, driving more interest and capital to these asset classes.

Crowdfunding, the most basic form of fractional investing started a long time ago. Crowdfunding has a few drawbacks compared to fractional share investing, but it proved itself in reducing the entry barrier for many kinds of assets.

Fun Fact: The first recorded successful crowdfunding occurred in 1997 when a British rock band funded their reunion tour through online donations from fans.

- Art

- Alternative assets, like wine, cars, watches

- Real estate

- Businesses

- People or human capital

Pros of fractional investing

- Diversification: For investors who want to diversify but don’t have the ability to access certain asset classes, fractional investing levels the playing field.

- Frequent income: Other than dividends from public stocks, passive cash-flowing investments can be difficult to find. Rent rewards on Proptee are really attractive for this exact reason.

Cons of fractional investing

- Liquidity: Crowdfunding platforms don’t offer the same liquidity as a typical stock or bond investment.

- Lack of leverage: Most platforms don’t offer loans using fractions as collateral, so exposure to these assets is limited.

Fractional NFTs

Fractional NFTs, or non-fungible tokens represent a new era of asset ownership that’s decentralized and transparent.

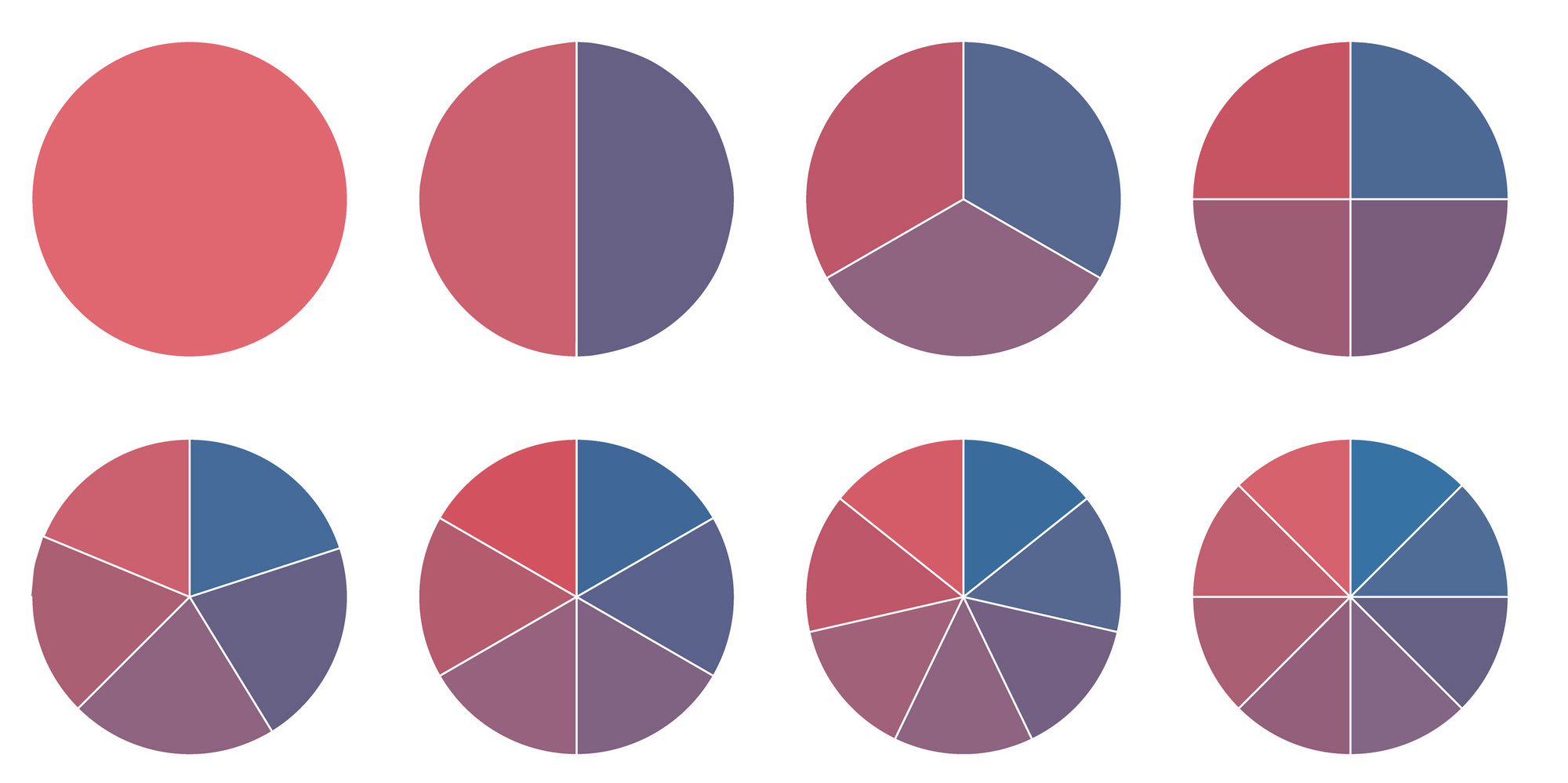

A fractional NFT is simply a whole NFT that has been divided into smaller fractions, allowing different numbers of people to claim ownership of a piece of the same NFT.

The NFT is fractionalized using a smart contract that generates a set number of tokens linked to the indivisible original. These fractional tokens give each holder a percentage of ownership of an NFT, and can be traded or exchanged on secondary markets.

Proptee operates the same way. We create one NFT of the title deed of the property which represents the ownership of the whole property. Then we fractionalise this NFT into smaller pieces via issuing a fungible token, a fraction backed by the NFT.

This way, real estate investing can be truly accessible for anyone, doesn’t matter where they live or what language they talk. In addition, as the market is bigger, liquidity becomes higher.

Did you enjoy this article? Sign up here to get it in your inbox every week on Wednesday.